Are you curious about De Master Blenders stock and what makes it stand out in the market? Whether you’re considering investing or simply want to understand its performance, this article will give you clear insights.

You’ll learn about the company’s background, recent stock trends, and key factors that could impact your investment decisions. By the end, you’ll feel confident navigating the world of De Master Blenders stock with the knowledge you need to make smart choices.

Keep reading to discover what sets this stock apart and how it might fit into your financial goals.

You May Like

- New BPA-Free pitcher and stainless steel uni-body blade that includes four…

- Food emulsifier pulverizes and liquefies whole fruits and vegetables in…

- Helps retain vitamins, minerals, antioxidants, and phyto-nutrients.

- Makes hot foods like soups, sauces, coffees, and fondues with centrifugal…

- INTERCHANGEABLE MASTER POD: Easily switches from Master Prep Pitcher to…

- POWERFUL 400-WATT MOTOR: Transforms ice cubes into creamy frozen drinks and…

- 48-OZ MASTER PREP PITCHER: Perfect for shakes and smoothies.

- 2-CUP MASTER PREP BOWL: Easily process up to two cups of fresh ingredients…

- Lightweight 6-Cup Jar – The plastic 6-cup (48-oz.) jar is easy to handle…

- 4-Point Blade – The multi-level stainless steel blade blends at multiple…

- Measuring Lid – The clear lid insert doubles as a 1-ounce measuring cup,…

- Dishwasher-Safe Parts – Cleanup is a breeze with the dishwasher-safe…

Company Background

De Master Blenders is a well-known company in the coffee and tea industry. It has built a strong reputation for quality and tradition. Understanding its background helps explain its market position and stock value.

History And Origins

De Master Blenders began as a small business in the Netherlands. It grew steadily by focusing on premium coffee and tea products. The company expanded through mergers and acquisitions. This growth helped it reach international markets quickly. Its roots date back to the early 18th century.

Key Brands And Products

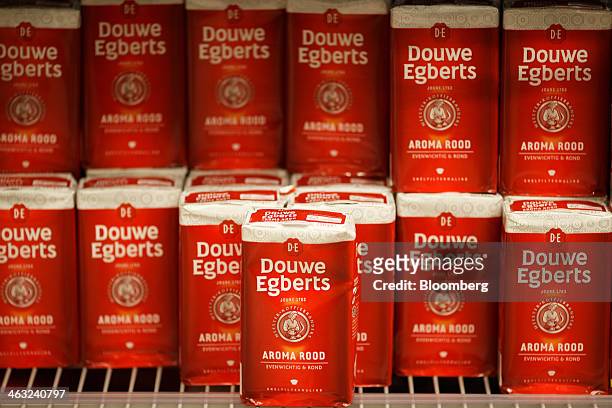

The company owns several popular brands known worldwide. These include Douwe Egberts and Senseo. Their products range from ground coffee to instant mixes. Tea offerings also hold a significant share in the market. These brands focus on delivering quality and taste to consumers.

Management Team

De Master Blenders’ management team has strong industry experience. Leaders focus on innovation and market growth. They guide the company through competitive global markets. The team aims to balance tradition with modern business strategies. This leadership ensures steady progress and stability.

Stock Market Performance

De Master Blenders stock has shown notable activity in recent years. Investors watch its market performance closely to understand its value and potential. This section explores key aspects like price trends, volatility, 52-week highs and lows, and dividend history.

Price Trends And Volatility

The stock price of De Master Blenders has experienced fluctuations due to market conditions and company news. Periods of steady growth alternate with sharp dips, reflecting market reactions. Volatility remains moderate, which appeals to investors seeking balanced risk. Tracking these trends helps investors time their entries and exits effectively.

52-week Highs And Lows

De Master Blenders stock reached its 52-week high during strong market phases. These peaks indicate investor confidence and positive company outlook. Conversely, the 52-week low marks moments of market uncertainty or external pressures. Understanding these points offers insight into the stock’s resilience and long-term potential.

Dividend History

De Master Blenders has maintained a consistent dividend payout over recent years. Regular dividends attract income-focused investors and signal financial stability. The company’s dividend history shows steady or slightly increasing payments, which reflects ongoing profitability. Monitoring dividend patterns helps investors evaluate total returns beyond stock price gains.

Financial Health

De Master Blenders’ financial health reveals the company’s ability to sustain growth and manage expenses. Understanding its financial status helps investors assess stability and potential risks. The financial data from recent quarters offers clear insights into the company’s performance.

Analyzing key financial aspects like earnings, revenue, profit margins, debt, and liquidity provides a complete picture. These elements reflect how well the company handles market challenges and maintains operational strength.

Quarterly Earnings

De Master Blenders reports quarterly earnings that show its recent profitability. Earnings fluctuate with market demand and production costs. Consistent earnings growth indicates strong operational efficiency. Quarterly reports also highlight how external factors impact the company’s income.

Revenue And Profit Margins

The company’s revenue reflects total sales from its beverage brands. Steady revenue growth signals healthy market demand. Profit margins measure the percentage of revenue kept as profit after expenses. High profit margins suggest effective cost control and pricing strategies.

Debt And Liquidity

Debt levels show how much the company owes to lenders. Low or manageable debt reduces financial risk. Liquidity measures the company’s ability to cover short-term obligations. Strong liquidity ensures smooth daily operations and financial stability.

Credit: www.wsj.com

Market Position

De Master Blenders holds a strong market position in the coffee and tea industry. It competes among top brands with a diverse product range. Its strategic moves and brand strength help maintain a solid presence. Understanding its market position reveals how it competes and grows globally.

Competitive Landscape

De Master Blenders faces competition from global and local beverage companies. Brands like Nestlé and JDE Peet’s are key rivals. The company differentiates through quality and brand recognition. It invests in innovation and marketing to stay ahead. Competition drives the company to improve constantly.

Global Market Reach

The company sells products in many countries across Europe and Asia. It reaches millions of consumers through retail and online stores. Its international presence supports steady revenue streams. Expanding distribution channels boosts access to new customers. Global reach strengthens brand visibility worldwide.

Growth Opportunities

Emerging markets offer new chances for De Master Blenders. Rising coffee and tea demand creates space for expansion. The company explores product diversification and healthier options. Partnerships and acquisitions open doors to fresh markets. These strategies aim to increase market share and profits.

Investment Considerations

Investing in De Master Blenders stock requires careful thought. Understanding key factors helps make better decisions. This section covers important points to consider before investing.

Reviewing valuation metrics, risks, and analyst ratings can guide your investment choices. Each factor provides insight into the company’s financial health and market position.

Valuation Metrics

Valuation metrics show if the stock price matches company value. Common measures include price-to-earnings (P/E) ratio and price-to-book (P/B) ratio. A low P/E might indicate undervaluation. Compare these metrics with industry peers for context. Also, look at dividend yield for income potential. These numbers reveal how the market values De Master Blenders.

Risks And Challenges

Every investment has risks. De Master Blenders faces market competition and changing consumer tastes. Economic shifts can affect demand for coffee and tea products. Supply chain disruptions may impact costs and delivery. Currency fluctuations also pose risk for international sales. Investors should weigh these factors carefully before buying stock.

Analyst Ratings

Analyst ratings offer expert views on the stock’s future. Ratings range from buy, hold, to sell. Analysts study company reports, market trends, and earnings. A consensus rating can signal market confidence or caution. Check recent rating changes for updated insights. These opinions help gauge investment potential.

Credit: www.shutterstock.com

Future Outlook

The future outlook for De Master Blenders stock shows promising signs. The company operates in a competitive market with changing consumer tastes. Its ability to adapt will affect its growth and stock value. Understanding key factors like industry trends, expansion plans, and sustainability initiatives helps predict its future.

Industry Trends

The coffee and tea market grows steadily worldwide. Consumers prefer quality and convenience in their beverages. Health-conscious choices increase demand for organic and natural products. De Master Blenders benefits by offering premium brands. Digital sales channels and direct-to-consumer models gain popularity. These trends may boost the company’s revenue and stock performance.

Expansion Plans

De Master Blenders plans to enter new markets. Emerging economies offer fresh opportunities for growth. The company invests in production capacity and innovation. Partnerships with local firms help ease market entry. Expanding product lines targets a broader customer base. These moves could enhance the company’s market share and investor confidence.

Sustainability Initiatives

Environmental responsibility shapes De Master Blenders’ strategy. The company focuses on reducing waste and energy use. Sustainable sourcing of coffee and tea supports farmers and ecosystems. These efforts appeal to socially aware consumers and investors. Strong sustainability practices may improve the company’s reputation and long-term stability.

How To Invest

Investing in De Master Blenders stock can be a smart choice for those interested in the beverage industry. Understanding the process helps you make informed decisions. This section explains how to buy DEMB shares, use brokerage platforms, and consider tax rules.

Buying Demb Shares

Start by researching the current price of DEMB shares. You can buy shares through stock exchanges where De Master Blenders is listed. Check if your country allows trading of this stock. Decide how many shares you want to buy. Place an order through your broker or trading app. Monitor the stock price and company news regularly.

Using Brokerage Platforms

Choose a reliable brokerage platform that offers access to DEMB shares. Look for platforms with low fees and good user reviews. Create an account by providing your personal details. Deposit funds into your brokerage account before buying shares. Use the platform’s search tool to find De Master Blenders stock. Follow the step-by-step process to place your buy order. Keep your account secure with strong passwords and two-factor authentication.

Tax Implications

Understand tax rules in your country before investing. Earnings from selling shares may be subject to capital gains tax. Some countries also tax dividends paid by the company. Keep records of all transactions for tax reporting. Consult a tax advisor to know your obligations. Proper tax planning can help avoid surprises later.

Credit: www.gettyimages.com

Frequently Asked Questions

What Is De Master Blenders Stock Ticker Symbol?

De Master Blenders stock is commonly traded under the ticker symbol DEMB on European exchanges. This symbol helps investors easily identify the company’s shares in the market.

Where Can I Find De Master Blenders Stock Price History?

You can find De Master Blenders stock price history on financial websites like Investing. com and MarketScreener. These platforms provide detailed historical data and performance charts.

Who Owns De Master Blenders Currently?

De Master Blenders is owned by Mondelez International, a global leader in snacks and beverages. The acquisition has integrated De Master Blenders’ brands into Mondelez’s portfolio.

What Are De Master Blenders’ Popular Brands?

De Master Blenders is known for premium coffee and tea brands like Douwe Egberts and Pickwick. These brands enjoy strong recognition in international markets.

Conclusion

De Master Blenders stock reflects the company’s steady presence in the beverage market. Investors watch its price changes and financial reports closely. Understanding past trends helps predict future moves. Always research before making any stock decisions. This stock offers insights into the coffee and tea industry.

Stay informed and follow market updates regularly. Knowledge supports smarter investment choices and better financial planning.